Gift Tax 2025 Exclusion. In 2025, the annual exclusion stands at $18,000. This credit eliminates federal gift tax liability on the first taxable gifts made in one's lifetime, up to the $13,610,000 exemption amount in 2025.

For 2025, the annual gift tax exclusion is $18,000, up from $17,000 in 2025. There’s no limit on the number of individual gifts that.

Annual Gifting For 2025 Image to u, The federal gift tax exclusion is a powerful tool for those looking to gift substantial amounts without incurring taxes. 2025 lifetime gift tax exemption limit.

Irs Gift Exclusion 2025 Happy Kirstyn, This credit eliminates federal gift tax liability on the first taxable gifts made in one's lifetime, up to the $13,610,000 exemption amount in 2025. This allows a wealthy married couple to.

Lifetime Estate Gift Tax Exclusion 2025 Rebe Alexine, For 2025, the annual gift tax limit is $18,000. The basic gift tax exclusion or exemption is the amount you can give each year to one person and not worry about being taxed.

Gift Tax Exclusion Reform What You Should Know YouTube, The lifetime gift tax exemption is the amount of money or assets the government permits you to give away over the course of your lifetime without having to pay the federal gift tax. This is known as the “gift tax.

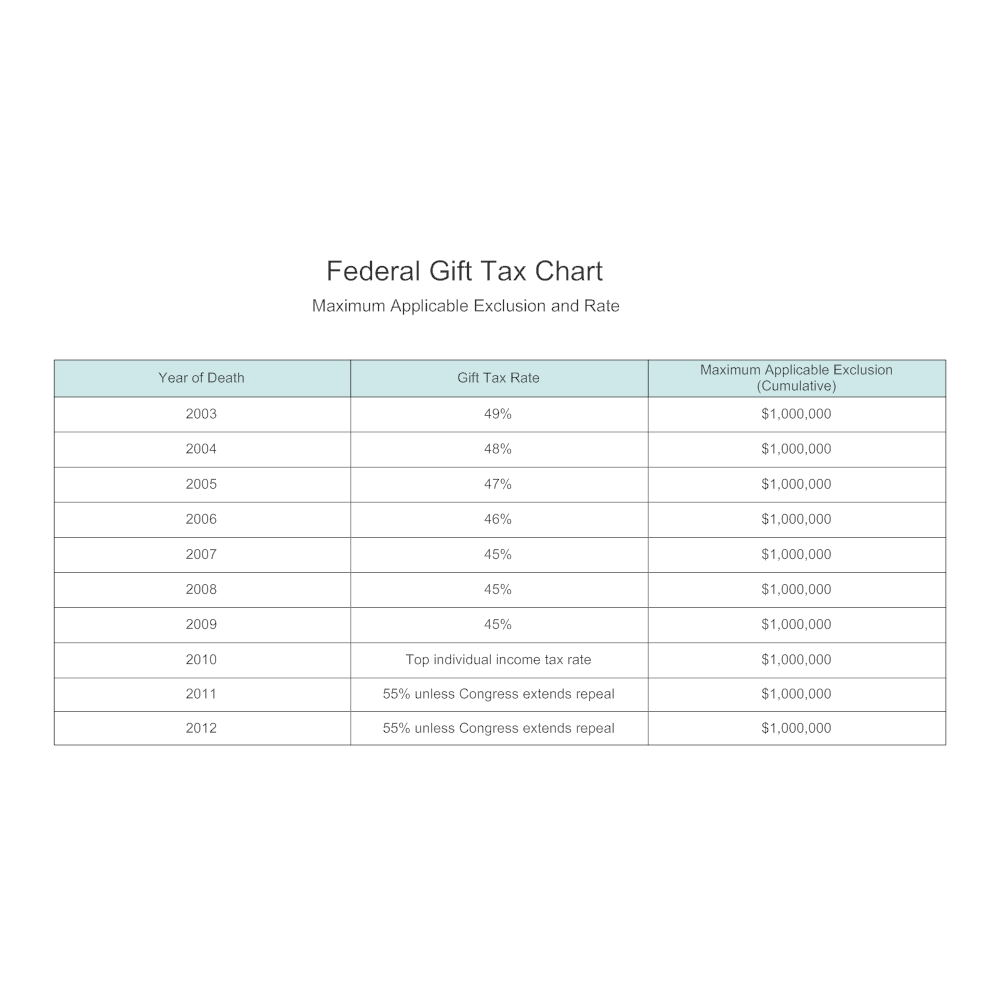

What is a Gift Tax Exclusion? YouTube, Taxpayers typically only pay gift tax on the amounts that exceed the allotted lifetime exclusion, which was $12.92 million in 2025 and is $13.61 million in 2025. Gift tax rates range from 18% to 40%.

Taxation Basics Tax, Estate Tax, Gift Tax, Annual Exclusion, The federal gift tax exclusion is a powerful tool for those looking to gift substantial amounts without incurring taxes. In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

Annual Gift Tax Exclusion For 2025 adrian andriana, Estate, gift and gst tax exemption. Double if married), to as many people as.

Irs Gift Exclusion 2025 Carin Cosetta, The gift tax exclusion limit for 2025 was. The exclusion will be $18,000 per recipient for 2025—the highest exclusion amount ever.

What Is The Gift Tax Rate For 2025 Phaedra, This number is more important than the annual number because when you exceed the lifetime. In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

Annual Gift Tax Exclusion Definition, Strategies, & Usual Errors, This credit eliminates federal gift tax liability on the first taxable gifts made in one's lifetime, up to the $13,610,000 exemption amount in 2025. Gift tax exclusion limit in 2025 and 2025.

The federal gift tax exclusion is a powerful tool for those looking to gift substantial amounts without incurring taxes.